Ohio PJM

Competitive Market Analysis

The rising SSO rates in Ohio can be attributed to various causes on top of the increasing wholesale price mainly because of the existence of alternative suppliers creating competition, and the high marginal cost of energy sources. While the state regulatory body could intervene in the market to lower prices it’s important to consider the long-term impacts of such interventions on the overall energy market in Ohio.

Demand v.s. Total Marginal Cost

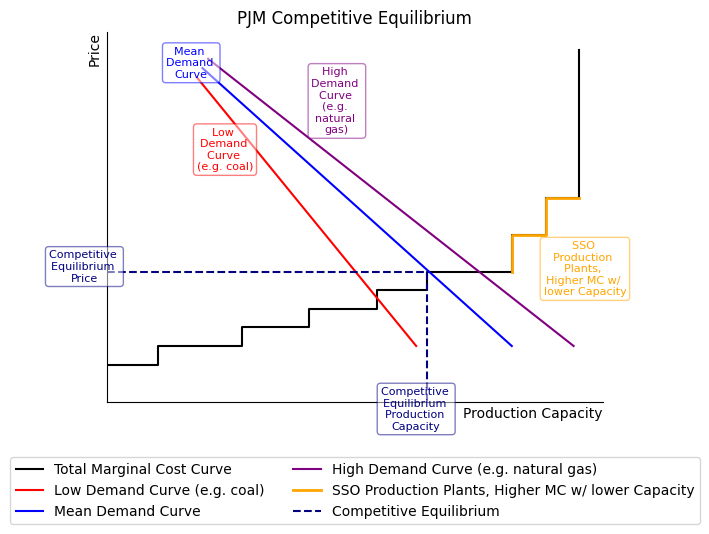

PJM oversees auctions through a complex bidding process where electricity suppliers submit bids indicating the amount of electricity they are willing to supply for a specific period. The lowest bids are accepted until sufficient electricity is procured to meet market demand. This process is graphically represented by the marginal cost curve, depicted as a step-wise function.

Alternative energy suppliers typically have lower marginal costs and higher production capabilities, leaving the standard service supplier (SSO) with higher marginal costs and lower production quantities on the curve. These alternative suppliers often have access to various energy sources, such as renewables or nuclear power, which generally have lower marginal costs than the coal-dependent sources the SSO relies on. However, due to the high demand for natural gas and other renewables, coal remains the primary option for the SSO. Consequently, with higher marginal costs and lower production quantities, the SSO may need to charge consumers more to maintain profitability.

Energy Market in Ohio

Ohio’s energy market operates under a deregulated framework, creating a competitive environment where consumers can choose among various energy suppliers. This competition is intended to drive innovation, improve efficiency, and ultimately reduce prices for consumers. Despite the advantages of this model, recent observations have shown a rise in Standard Service Offer (SSO) rates, a default option for consumers who do not select an alternative supplier.

The SSO rate increase is a multifaceted phenomenon influenced by several factors, including the mechanisms of the PJM Interconnection’s competitive equilibrium model. PJM, a regional transmission organization, coordinates the movement of wholesale electricity and operates its market through auctions. These auctions determine wholesale prices, directly influencing retail energy provider rates. Interestingly, while the cost of natural gas, a predominant source of electricity in the US, has decreased, Ohio’s SSO rates have risen. This contradiction stems from the complex interplay between market forces and regulatory environments.

One significant aspect of this dynamic is the Cournot competition model, which characterizes Ohio’s energy market. In a Cournot model, each supplier determines its output to maximize profit while considering competitors’ output. This leads to higher prices and reduced consumer surplus compared to a perfectly competitive market. To mitigate high prices, Ohio’s Public Utilities Commission (PUCO) encourages market entry, lowering regulatory barriers and certifying more suppliers.

However, challenges persist. One significant issue is the limitation of energy transmission, which hampers the effectiveness of localized competition. Furthermore, fixing or limiting prices by regulation might demotivate investment in new generation or transmission infrastructure, eventually leading to reduced supply and reliability.

Moreover, the market’s complexity is evident in the auction mechanism used to set SSO rates. These auctions operate similarly to a Bertrand non-cooperative game, where firms undercut each other’s prices to secure market share. This competitive bidding process is influenced by the differing marginal costs of electricity production sources. Alternative energy suppliers often have lower marginal costs due to diverse sources like renewables or nuclear power, whereas the SSO tends to rely more on coal, which has higher marginal costs and lower production quantities. Consequently, the SSO must charge higher rates to maintain profitability.

The rising SSO rates are also partially attributed to an increase in wholesale electricity prices set during PJM auctions, reflecting the market’s demand and supply dynamics. Factors such as shifts in demand and supply curves create temporary market equilibrium imbalances, driving wholesale prices up and subsequently increasing SSO rates.

In conclusion, while Ohio’s deregulated energy market fosters competition and has potential benefits, the rising SSO rates present a complex challenge. Balancing market competition and regulatory intervention is crucial. Strategies such as promoting market entry, enhancing production efficiencies, and carefully crafting regulatory measures are essential to ensure long-term stability and affordability in Ohio’s energy market.